A coalition led by Brenau University received a federal grant of $22,000 this spring to provide free tax preparation help to low- to moderate-income Georgians.

The grant is funded by the Internal Revenue Service as part of the Volunteer Income Tax Assistance grant program, which seeks to improve the quality of tax returns submitted to the IRS each year and increase the number of electronically filed returns. It is estimated that families who take advantage of the VITA program save an average of $300 per return over those that prepare their returns themselves.

Students are a big part of the VITA program, particularly Brenau students in Gainesville.

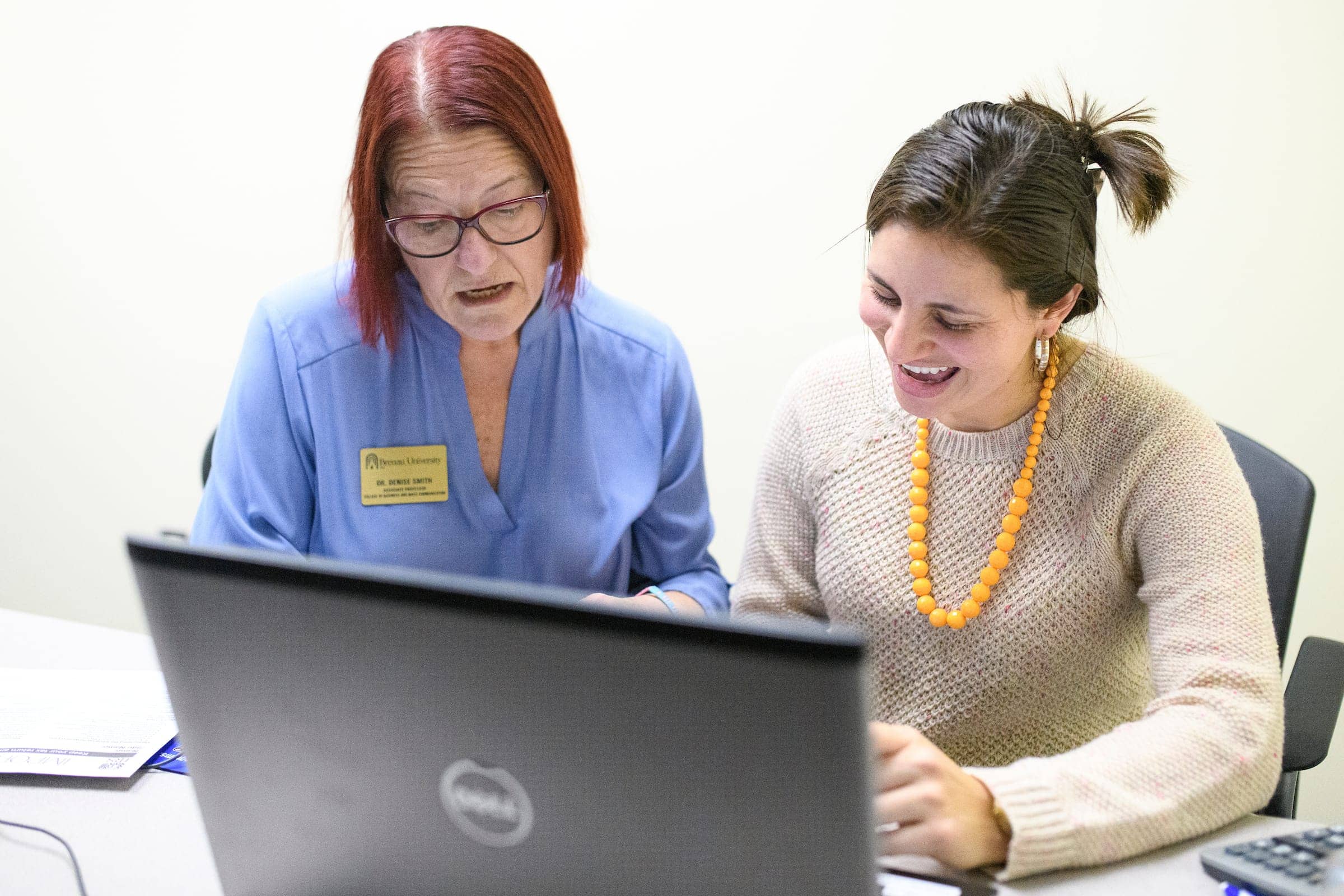

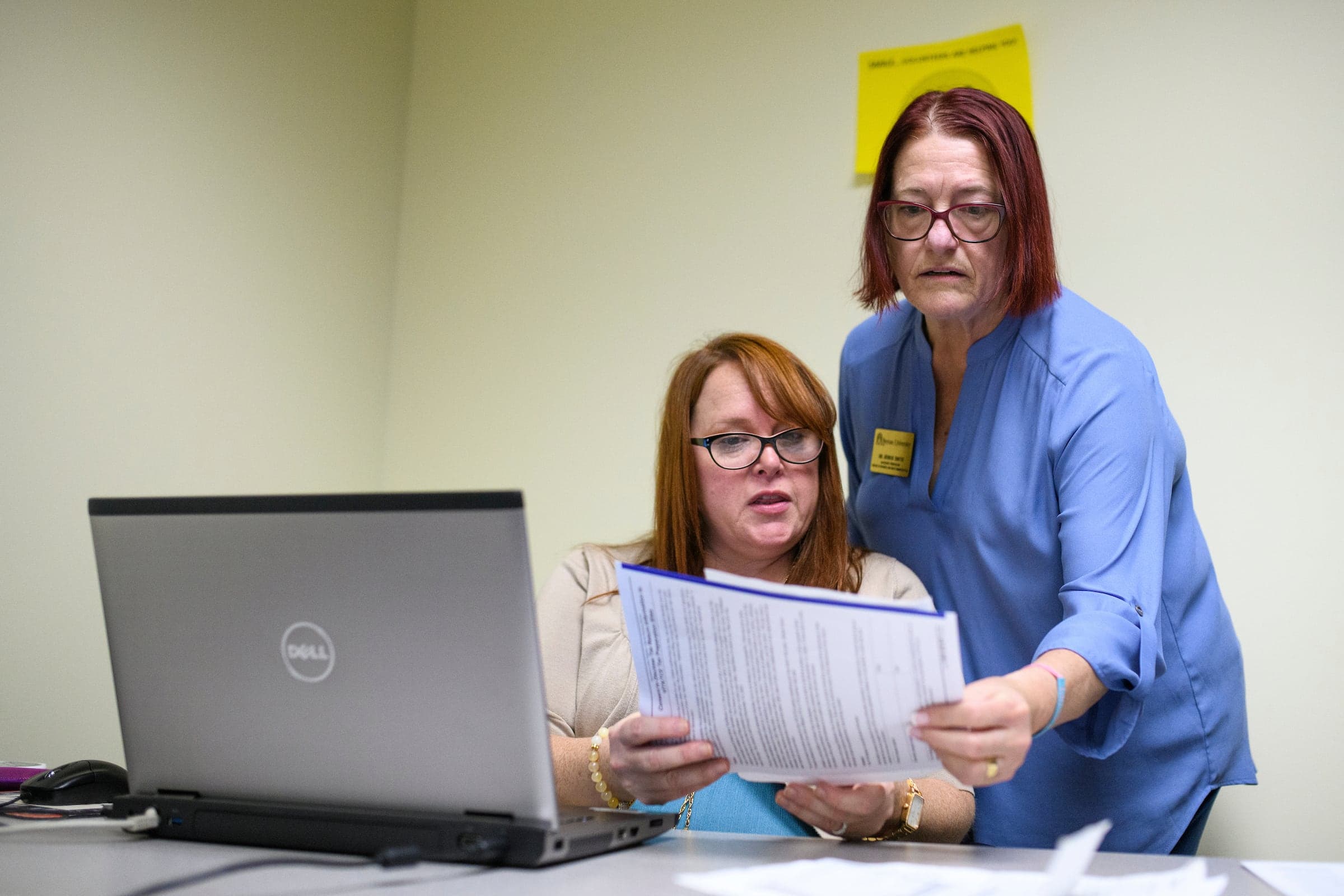

“Working with VITA is a great learning opportunity for Brenau business and accounting students,” said Denise Smith, accounting program director and associate professor in the Brenau College of Business and Communication. “It’s a lot of work, but it is very rewarding.”

Senior Sarah McEnnan has been volunteering with the program since it started in February and said seeing all of the different taxation forms has helped her prepare for the future.

“Today I’ve had quite a few different scenarios I haven’t had before,” McEnnan said. “So I’ve had that experience. You don’t know what to expect until you really get into it.”

Graduate student Liliam Ramos said besides experience, a huge positive of this program is being able to work with the community.

“It has been great,” she said. “I feel really useful helping people that basically cannot afford to pay tax preparers. You feel like you’re helping them a lot.”

Smith said they have processed roughly 200 returns as of March 30 and have seen around $180,000 in refunds.

The coalition covers the entire state and includes Brenau University, Gainesville Business Assistance, The University of Georgia Cooperative Extension, the Georgia Credit Union and Action Ministries. In total, the group expects to submit over 1,000 returns electronically this year. The IRS grant funding will be used to extend VITA services to Georgians living in rural parts of the state and to those with limited English proficiency through the addition of online services.

Assistance is available to Georgians in the Gainesville area each Saturday from 9 a.m. to 4 p.m. during tax season at the Community Service Center at 430 Prior Street, S.E. in Gainesville. For less waiting, a virtual drop-off/pickup of returns is available on Monday and Friday afternoons between 2-5 p.m.

Households with an annual gross income of $57,000 or less are eligible to take advantage of VITA services. Appointments are not required but can be scheduled by calling 770-535-7066.